Glanbia reports a strong first quarter for 2021

Agribusiness Beef Co-op Corporate Dairy

Glanbia reports a strong Q1, Full Year 2021 Adjusted earnings per share on a constant currency basis, growth expected to be upper end of 6% to 12%.

Global nutrition group Glanbia plc is issuing this Interim Management Statement for the three month period ended 3 April 2021 (“first quarter” or “Q1 2021” or “Q1”). This statement is issued in conjunction with the plc’s Annual General Meeting (“AGM”) which is being held today.

Summary

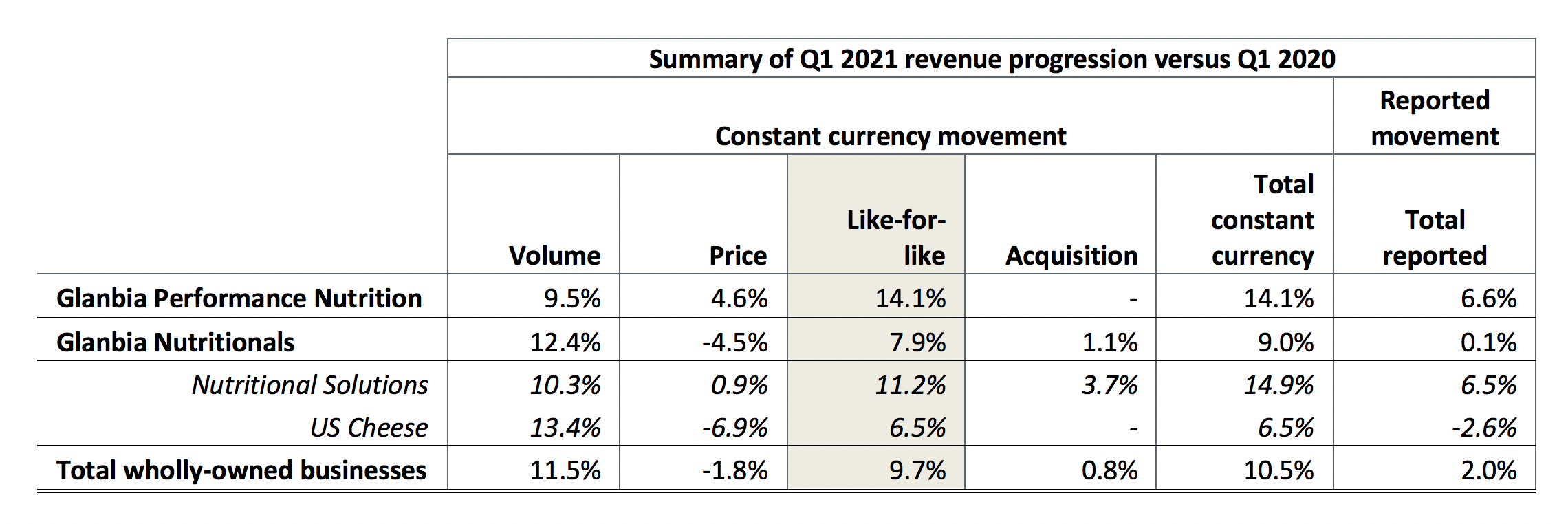

- Q1 2021 wholly-owned revenues up 10.5% on a constant currency basis (up 2.0% reported) versus prior year due to good demand across both Glanbia Performance Nutrition (“GPN”) and Glanbia Nutritionals (“GN”);

- Q1 like-for-like1 (“LFL”) wholly-owned revenue growth of 9.7% versus prior year;

- GPN delivered revenue growth in Q1 2021 of 14.1% on a constant currency basis with LFL branded revenue growth of 17.6% largely driven by strong demand in North America and Asia Pacific;

- GN Nutritional Solutions (“NS”) delivered volume growth in Q1 2021 of 10.3% driven by strong customer demand for vitamin and mineral premix and solid trends in dairy solutions;

- GPN Transformation Programme on track and delivering revenue and margin improvements;

- Strong operating cash flow; net debt at the end of Q1 2021 of €498.5 million, a decrease of €191.6 million versus the net debt position in the prior year; and

- Following a strong first quarter. Glanbia expects FY 21 adjusted EPS to be in the upper end of the previously guided range of 6% to 12% growth on a constant currency basis.

Commenting today, Siobhán Talbot, Group Managing Director said:

“I would like to thank our colleagues and partners around the world for their continued resilience in managing the challenges of Covid-19, keeping supply chains going, delivering essential nutrition and helping Glanbia to deliver a strong start to 2021. In the first quarter of 2021 Glanbia’s revenues increased by 10.5%, constant currency, versus the prior year. Revenue growth was driven by improving trading conditions in North American and Asia Pacific markets for both the GPN and GN business segments. Globally, as we emerge from the pandemic, health, wellness and nutrition are prominent consumer trends. In our portfolio, we saw in Q1 strong consumer demand for the Optimum Nutrition brand within GPN and for vitamin and mineral premix from customers of Nutritional Solutions with revenue growth also reflecting the reopening of certain markets and channels. While the strong underlying demand for Glanbia’s health and wellness focused portfolio is continuing into the second quarter we remain vigilant to the continued volatile and disruptive potential of the Covid-19 pandemic.

The strong first quarter gives us confidence for the remainder of the year and we expect FY 21 adjusted EPS growth to be in the upper end of the previously guided range of 6% to 12% on a constant currency basis.”

Summary revenue progression

In the three months ended 3 April 2021 compared to the same period in 2020, wholly-owned revenue increased 10.5%, constant currency. On a reported basis, reflecting the weaker US Dollar Euro foreign exchange rate2, revenue increased 2.0%. The drivers of the revenue increase, on a constant currency basis was volume growth of 11.5% offset by a price decline of 1.8% and the Foodarom acquisition representing 0.8%. Volume growth was broad based and reflected strong demand across Glanbia’s end-markets, in particular in North America and Asia Pacific. Price decline related to lower year-on-year US Cheese market prices which offset price improvement in GPN and Nutritional Solutions in the period. The Foodarom acquisition completed by the GN segment in August 2020 is performing well.

Outlook

The Group remains vigilant to the continued volatile and disruptive potential of the Covid-19 pandemic. However, Glanbia has started 2021 well with strong revenue growth in the first quarter as trading conditions have improved in key regions in North America and Asia Pacific. This more than offset headwinds in European markets related to ongoing Covid related restrictions across the region. Some revenues in the first quarter are attributable to the reopening of channels and markets, however there is strong underlying demand for Glanbia’s health and wellness focused portfolio which is continuing into the second quarter. Glanbia is confident of delivering good revenue growth in both GPN and Nutritional Solutions in FY 2021 assuming restrictions continue to ease in key markets.

The GPN Transformation Programme will support the delivery of double-digit margins in GPN in FY 2021 and will enable the business to invest in increased brand marketing as well as counteract some raw material inflation, which is expected in the second half of the year.

Following a strong first quarter performance, Glanbia expects FY 2021 adjusted EPS growth to be in the upper end of the previously guided range of 6% to 12% on a constant currency basis.

AGM

Glanbia is holding its AGM at 11am today at the Company’s head office, Glanbia House, Kilkenny, R95 E866, Ireland. Due to restrictions currently in place in Ireland to limit the spread of Covid-19 the meeting will be held as a closed meeting. Shareholders who wish to participate remotely in the AGM can find details on how to do so on the Company’s website: www.glanbia.com/agm For further details, see full statement here.